I used to be a collector. I collected trading cards. I collected comic books. I collected pins and stickers and mementos of all sorts. I had boxes of things I’d collected but which essentially served no purpose.

I can’t say I’ve shaken the urge to collect entirely, but I have a much better handle on it than I used to. A few years ago, I sold my comic collection and stopped obsessing over them. Today, I collect three things: patches from the countries I visit, pins from national parks, and — especially — old books about money.

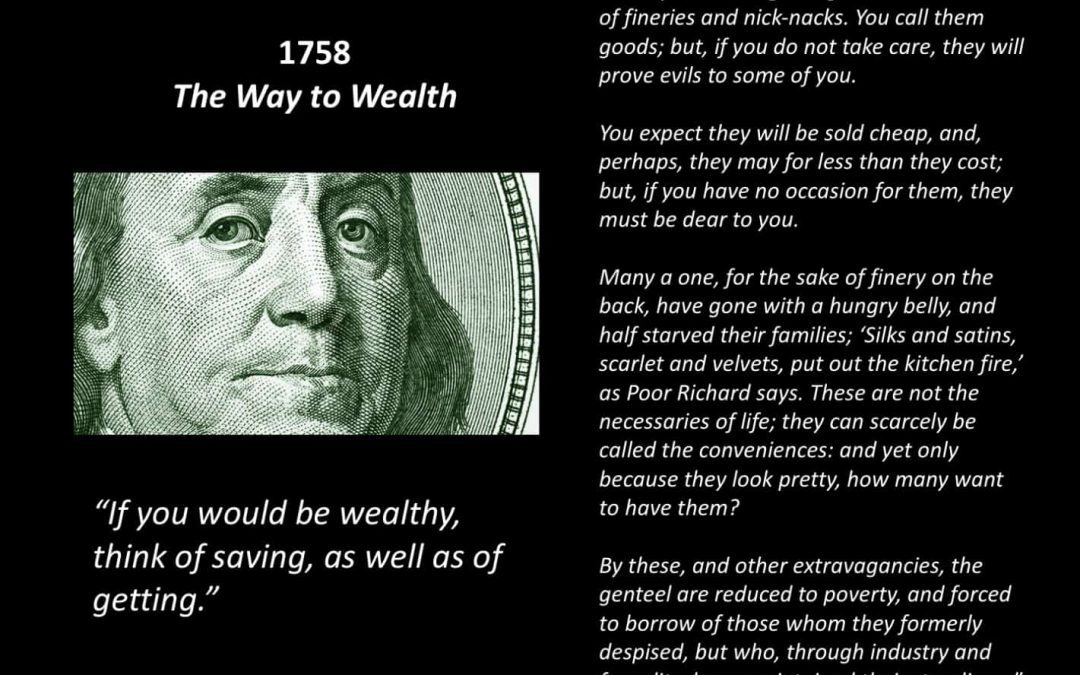

Collecting old money books is fun. For one, it ties to my work. Plus, there’s not a huge demand for money manuals, so there’s not a lot of competition to buy them. (Exception: As much as I’d love a copy of Ben Franklin’s The Way to Wealth, so would a lot of other people. That one is out of my reach.)

One big bonus from collecting old money books is actually reading these books. They’re fascinating. And it’s interesting to trace the development of certain ideas in the world of personal finance.

For instance, there’s this persistent myth of “lost economic virtue”. That is, a lot of people today want to argue that people were better at managing their money in the past. They weren’t. Debt (and poor money skills) has been a persistent problem since well before the United States was founded. It’s not like we, as a society, once had smart money skills and lost them. The way people manage money today is the way they’ve always managed money.

Or there’s the notion of financial independence (and the closely-related topic of early retirement). The standard narrative goes something like this:

- In 1992, Joe Dominguez and Vicki Robin published Your Money or Your Life, and that marks the “discovery” of FIRE.

- In the late 2000s, Jacob from Early Retirement Extreme picked up the FIRE banner, then handed it off to Mr. Money Mustache a few years later.

- Today that banner is being carried by newcomers like Choose FI and the /r/financialindependence subreddit.

When you read old money books, however, you soon realize that FIRE isn’t new. These ideas have been kicking around for a while. Sure, the past decade has seen the systemization and codification of the concepts, but people have been preaching the importance of financial independence for about 150 years. Maybe longer.

Today, using my collection of old money books, let’s take a look at where the notion of financial independence originated.

This article is a work in progress. It’s something I’ve been thinking about for years, but I haven’t had the resources to actually write it until recently. And as I acquire more old books about money, I’m sure my insights will change. This particular version is based on a talk I gave last month at Camp FI in Colorado. In fact, some of the images I’m using here are taken from the slides for that talk.

In the Beginning

Who started the FIRE movement? Who “invented” financial independence? Who first came up with the concept? Despite my burgeoning library of money manuals, I don’t have a definitive answer. Not yet anyhow.

That said, the earliest reference I’ve found is Aesop’s fable of the Ants and the Grasshopper from about 560 BCE. (The grasshopper was a cicada in the original Latin, by the way.) Here’s an English translation of the original:

The ants were spending a fine winter’s day drying grain collected in the summertime. A Grasshopper, perishing with famine, passed by and earnestly begged for a little food. The Ants inquired of him, “Why did you not treasure up food during the summer?” He replied, “I had not leisure enough. I passed the days in singing.” They then said in derision: “If you were foolish enough to sing all the summer, you must dance supperless to bed in the winter.”

This fable clearly contains the germ of the financial independence idea, even if it doesn’t explicitly talk about F.I. and/or early retirement.

Now, I’m certain there are references to this concept in other ancient literature. I haven’t gone looking for them yet, however, so I can’t tell you where to find them. (If you know, please tell us in the comments.)

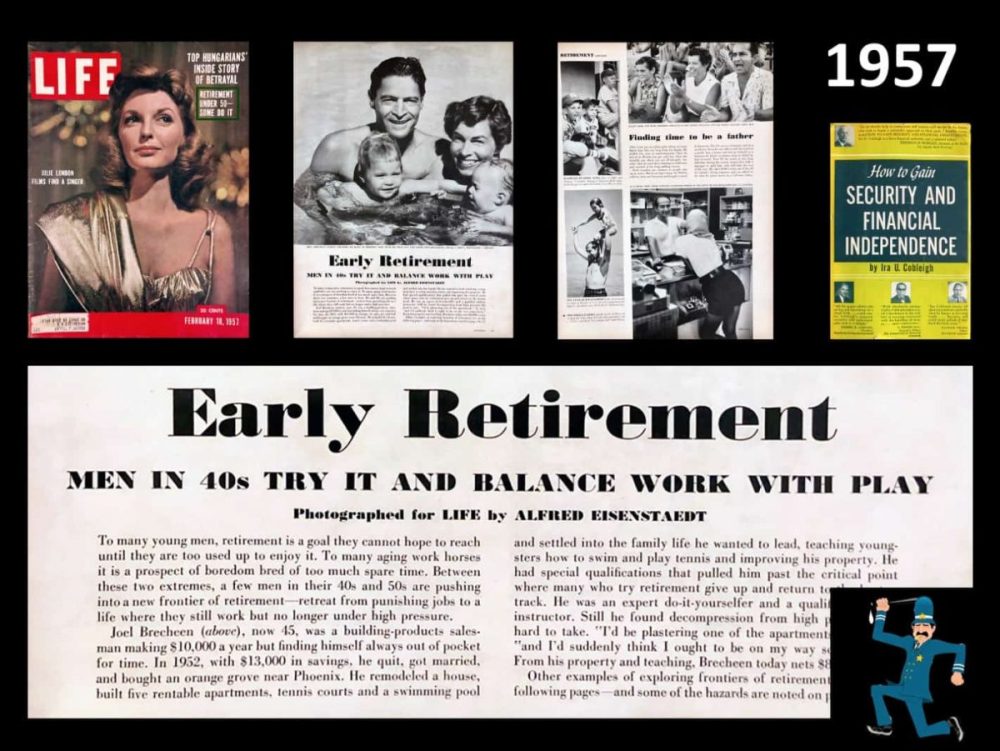

But if we jump forward 2250 years, we can see F.I. concepts quite clearly in the writing of Benjamin Franklin. “If you would be wealthy, think of saving, as well as of getting,” Franklin wrote in 1758’s The Way to Wealth. He noted that because they were so obsessed with nice things, many wealthy people are reduced to poverty and forced to borrow from people they once looked down upon.

In 1854, Henry David Thoreau published Walden. While I have some issues with this book (and with Thoreau), Walden contains a clear foundation for the modern FIRE movement. In fact, when I emailed Vicki Robin to ask what inspired her and Joe Dominguez to teach about financial independence, she specifically cited Thoreau. And it’s easy to see why. “The mass of men lead lives of quiet desperation,” he famously wrote. But he also wrote this:

The cost of a thing is the amount of what I will call life which is required to be exchanged for it, immediately or in the long run.

That quote from Walden sounds as if it could be lifted directly from Your Money or Your Life‘s discussion of life energy, doesn’t it?

In 1864 — during the American civil war — Edmund Morris published Ten Acres Enough, which documented his family’s moved from the city to the country in order to grow ten acres of fruits and berries. His goal was for his family to be self-sufficient, to obtain what we’d call financial independence.

Morris’ approach was typical of the day. He wrote:

No prudent man, accepting such a trust, and guaranteeing its integrity, would invest the fund in stocks. Our country is filled with pecuniary wrecks from causes like this…

Like many of his contemporaries, Morris thought stocks were a poor investment. He advocated investing in real estate. (And note his use of the word “pecuniary” instead of “financial”. We’ll come back to that in a moment.)

Fun trivia! In Ten Acres Enough, Morris doesn’t call the Civil War a “civil war”. He calls it “the slaveholders’ rebellion”. He also makes liberal use of the word “treason”. There’s no bullshit about the source of the war being “states’ rights” as we hear nowadays.

Coining a Term

In 1872, H.L. Reade published a book called Money and How to Make It. This is an amazing book — one of my favorites out of all the volumes I’ve picked up over the past few years. It tackles all sorts of diverse topics, and is quite progressive for its day.

Much of the book is, as the title suggests, about how to earn more money. To that end, Reade offers chapters on how to make money with geese and with ducks and with cattle. He talks about making cheese. He talks about becoming a doctor or a lawyer. But he also includes a chapter on “Woman’s Part in Making Money” and one on “The Brotherhood of Man”. Cool stuff for 1872!

But the reason this book is important is that it’s the first instance that I’ve been able to find where an author actually writes about financial independence. Here’s a quote from the book’s introduction:

We have purposely united with plain practical talk, enough of history and story to relieve the volume from any text book tendency, and believing, as we sincerely do, that no man or woman can read it without receiving a value far greater than its cost, we commend it to the calm consideration of every person who, like the writer, beginning comparatively poor, is anxious to reach what all men should desire and labor for, PECUNIARY INDEPENDENCE.

There you have it. The first reference (that I’ve been able to find so far) to the idea of financial independence.

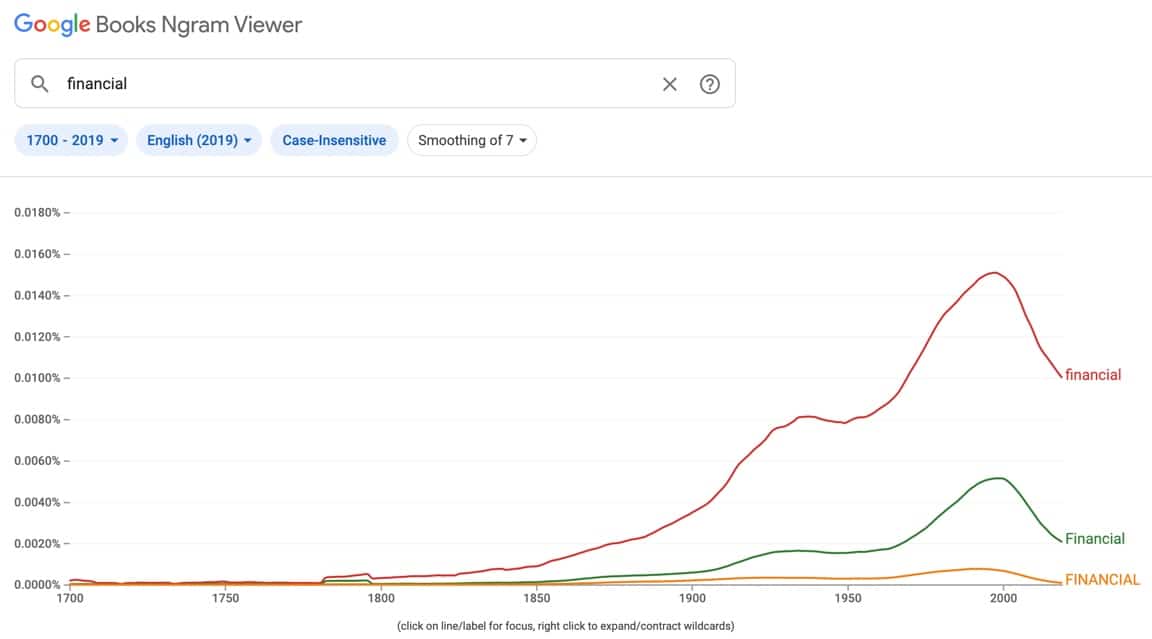

But wait. What’s up with Reade calling it “pecuniary independence”. That’s strange, isn’t it? Well, not really. Turns out that the word “financial” wasn’t yet in common use in 1872. The word had been around a few hundred years, but it wasn’t until the late 1700s that “financial” began to take on the definition it has today: “relating to money”. Before that, people used the word “pecuniary” instead.

Here are a couple of graphs that show how the usage of “financial” and “pecuniary” have changed over time.

It wasn’t until the late 1800s that “financial” supplanted “pecuniary” as the term of choice. In 1872, Reade didn’t write about “financial independence” because “pecuniary indepence” was the more common term!

Nerdy stuff, eh?

Another important early F.I. book was published at about this same time. In 1875, Scottish author and social reformer Samuel Smiles published Thrift, which was meant to conclude a trilogy of personal development books. (Smiles published Self-Help in 1859 and Character in 1871.)

In the preface to Thrift, Smiles writes:

Every man is bound to do what he can to elevate his social state, and to secure his independence. For this purpose he must spare from his means in order to be independent in his condition. Industry enables men to earn their living; it should also enable them to learn to live. Independence can only be established by the exercise of forethought, prudence, frugality, and self-denial. To be just as well as generous, men must deny themselves. The essence of generosity is self-sacrifice.

And Smiles begins the book by re-stating the fable of the Ants and the Grasshopper. For my money — and I haven’t read the entire book yet because I just got in the mail yesterday — this could very well be the first book about financial independence…even if it never uses that term precisely.

So, what’s the first actual reference to the term “financial independence”? I don’t have a definitive answer yet, but I do know its earliest appearance in my collection of old money books.

In 1919, Victor de Villiers published Financial Independence at Fifty, a collection of loosely-related articles that originally appeared in “The Magazine of Wall Street”. While the book itself doesn’t dwell on financial independence, the author includes this definition at the start:

What is financial independence? Freedom from dependence on others for guidance, government, or financial support. The spirit of self-reliance, or of freedom from subordination to others.

He also includes a chart showing “the six ages of investment” which is strikingly similar to my own list of the six stages of financial independence!

Financial Independence through the Years

From these humble origins, the concept of “financial independence” grew more complex and more robust. The path to financial independence became codified.

One of the first books to set out a system to help others become F.I. was the immensely popular The Richest Man in Babylon, which is quite possibly the best-selling money manual of all time.

The Richest Man in Babylon began as a series of pamphlets distributed through banks and insurance companies during the early 1920s. In 1926, author George Clason collected this material into book form for the first time. Over the years, Richest Man underwent several revisions until it reached the form we know today.

As you’re probably aware, Clason suggested the following seven commandments for building wealth.

- Start thy purse to fattening. (Save 10% of all you earn.)

- Control thy expenditures. (Avoid lifestyle inflation; curb desires.)

- Make thy gold multiply. (Use compounding to grow wealth.)

- Guard thy treasures from loss. (Avoid get-rich-quick schemes.)

- Make of thy dwelling a profitable investment. (Buy your home.)

- Insure a future income. (Plan for retirement.)

- Increase thy ability to earn. (Educate yourself.)

But there were plenty of lesser-known books published during the twentieth century that offered excellent financial advice and espoused the principles of financial independence.

In 1936, for instance, as part of a series of books called “The Franklin System”, Lansing Smith wrote Gaining Financial Security. This book (which is better than 90% of the money books being printed today!) might be the earliest book to promote financial independence as a concept by name and with a system. Here’s an excerpt (emphasis mine):

If you want financial independence, you must realize its great and lasting value as a desirable attainment. You must keep everlastingly at the task of making it come true. Finally, you must let nothing shake or weaken your determination to achieve your objective.

There is one factor you should understand thoroughly at the outset: The amount of one’s annual income has far less to do with ultimate financial independence than most people think. There are probably thousands of people with incomes many times the size of yours who are nevertheless deeply in debt and wholly unable to meet their obligations. On the other hand, many thousands have far less income than you have and yet they are managing to achieve financial security or are now maintaining and, indeed, increasing it.

Similar books followed. In 1946, in the wake of the second world war, John Durand published How to Build Financial Independence for a New Age. And during the 1950s, several books appeared with the term “financial independence” in their title. (Universally, however, these later books didn’t actually discuss financial independence. Instead, they were manuals for investing in the stock market.)

The 1960s and 1970s saw other books about financial independence appear, many of which promoted a philosophy that seems relatively workable by today’s standards. Then, in 1988, Paul Terhorst published what I consider the first modern FIRE book: Cashing In on the American Dream [my review].

Terhorst was 33 years old and a partner at a major accounting firm. But he began to wonder if he really wanted to be part of the rat race. Didn’t he have enough money already? It took him two years of playing with numbers, but eventually he realized that he could quit working if he wanted. At age 35, he retired. And he’s been retired ever since.

Early Retirement

You’ll notice that so far I’ve only discussed the origin of the concept of “financial independence”. What about early retirement? The modern FIRE movement combines these two notions under one roof. Why don’t older books do so?

The answer to this is complicated because the history of retirement is complicated.

You see, retirement as we know it has only existed for about 150 years. In reality, the definition of “retirement” has been in constant flux for most of that time. In the latter part of the 19th century (and the early part of the 20th century), retirement wasn’t considered desirable. It was called “mandatory retirement”, and it was something that people railed against.

One hundred years ago, retirement was a massive social issue, much the same way that immigration or gun rights are today. Many people opposed retirement. It wasn’t until the Social Security Act of 1935 that attitudes began to change. In time — by the 1950s, certainly — our modern view of retirement as a period of rest after of lifetime of work began to crystalize.

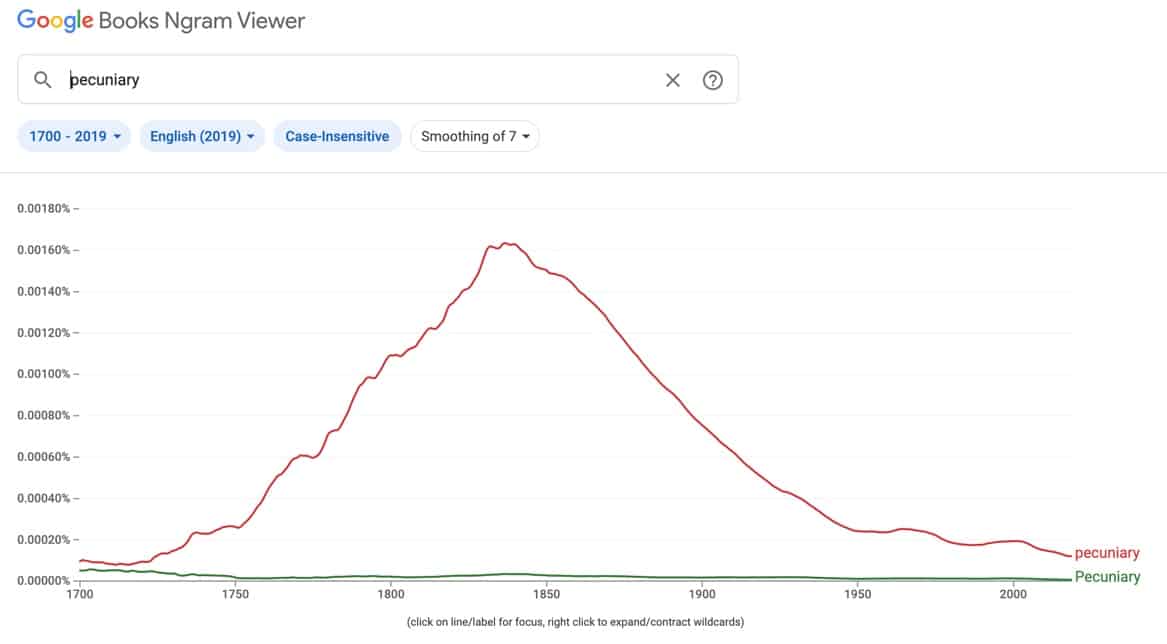

Once this happened, then a notion of “early retirement” became possible. And we can see society explore the idea through books and magazine articles.

The books tend to be academic and of little interest to us. The magazine articles, on the other hand, are interesting — especially since they portray early retirement as an opportunity to pursue other paid work. (This flies in the face of an attitude prominent in some quarters today, an attitude that says “you can’t be retired if you continue to work”. That idea was bullshit sixty years ago and it’s bullshit today.)

Final Thoughts

So, if financial independence isn’t a new concept, why hasn’t it caught on? If people have been preaching the power of financial freedom since 1872 (or before), why don’t more people know about it? I think there are a number of reasons.

Samuel Smiles — and people who adhere to his Victorian ideas — would argue that the reason F.I. hasn’t become more popular is that people are weak. As progressive as he was in his day, Smiles believed that poor people were poor because they made poor choices. There are many people who would make the same argument today. And while I certainly believe that poor choices can be a barrier to wealth, I think they’re a barrier for the middle and upper classes, not the lower class. I believe that poverty is often a result of systemic issues.

Note: Let me be clear, though, that regardless the source of poverty, I believe strongly that it is up to the individual to elevate her financial position. It doesn’t matter the reasons you’re poor. If you’d like to escape poverty, it’s up to you to make the choices required to do so. Then, after you’ve freed yourself, you can turn your attention to systemic issues, to helping other people rise up as well.

Perhaps the biggest change from 1872 to today is technology.

When Money and How to Make It was published, its reach was limited. First of all, it was expensive. The book cost $20 back then, which would be roughly equivalent to $400 in 2020. (You almost had to be financially independent to buy the book!) If you could afford to buy it, then what? Who could you share the info with? If you loaned the book to your sister or your neighbor, maybe you’d have a few people to talk about these ideas with, but mostly you were on your own.

Today, on the other hand, this information is ubiquitous. If you want to learn about financial independence and early retirement, there’s almost too much material out there for you. And it’s easy to find like-minded folks to talk with! There are Facebook groups, subreddits, blogs, podcasts, YouTube channels, and in-person meet-ups galore. Technology makes it easy to connect with other people who are interested in financial independence and early retirement.

But I think the real reason that F.I. ideas didn’t catch on in 1872 (or 1919 or 1936 or 1957 or 1988) is simple: Most people just don’t care. Some folks don’t believe the concepts work. (They do.) Others don’t believe the ideas apply to them and their situation. (They do.) And plenty of people simply aren’t willing to wait. The pursuit of financial indepence requires trading short-term comfort for long-term security. Humans aren’t hard-wired to think long term.

Because we’re a myopic species, it’s tough for us to plan five or ten or twenty years in the future. That was true 150 years ago. It’s true today.

I’m not saying that the FIRE movement is going to fade away and be forgotten. I don’t think it will, actually. But I do think that its appeal is limited. Most people are unwilling to make the choices and changes necessary to retire early. They’re okay with the standard path…even though that means they’ll be working until they’re 65. Or 70. Or older.

I suspect that 150 years from now, some kid will be digging through a digital archive and discover the dozens of FIRE blogs from 2020. And he’ll marvel at how the ideas he thought were original to him and his colleagues in 2170 have actually been around for decades. So, he’ll whip up a hologram for HoloTube and share what he’s learned about the history of financial independence and early retirement.

Because — to quote George Santayana — “those who cannot remember the past are condemned to repeat it”.

Recent Comments