Could you pay your mortgage, groceries, rent, insurance, medical expenses, and other bills on $2000/month? If you could, what kind of lifestyle might you lead?

Millions of retirees across America live it every day.

The Social Security Administration reports that 50% of elderly married beneficiaries and 70% of singles rely on Social Security for more than half of their monthly income. Considering that the average Social Security check is around $1361/month, this is a really tough place to be in for so many of these retirees.

And I’ve met them. Many of them.

Every year at my insurance agency, we meet thousands of baby boomers aging into Medicare at 65. We often see their shock, dismay, and confusion when they realize that the cost of their healthcare in retirement will easily eat up at least 20% to 30% of that Social Security check every month.

No matter how you slice it, even the best of the retiree budgeters out there are likely to have trouble making ends meet on Social Security income alone.

Sometimes when it comes to personal finance, budgeting isn’t the problem.

Sometimes income is the problem.

Fortunately, there’s good news on that front, because we live in an age where there are more opportunities to earn extra money than ever before. Our digital world has made this possible, and it couldn’t have come at a better time.

When you’re on a fixed income and struggling to make ends meet, a side hustle that pays you even a few hundred dollars a month can be a tremendous help.

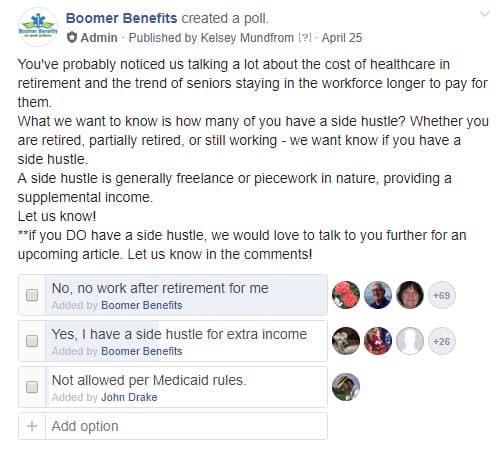

At Boomer Benefits, we polled our Facebook fans – largely baby boomers and seniors – to ask what kind of side-hustles they are rocking out there in the real world. What we learned is that there’s a wide array of ways in which creative retirees are supplementing their Social Security income.

Today, I’ll share a few of their stories to give you some ideas for your own possible side-hustle that could potentially help to reduce financial worry and afford you a better lifestyle in retirement.

Teach From Home

Did you know that you can get paid to teach English without leaving your house? That’s right, and this is a perfect example of a retirement side hustle that exists today that would not have been possible ten years ago.

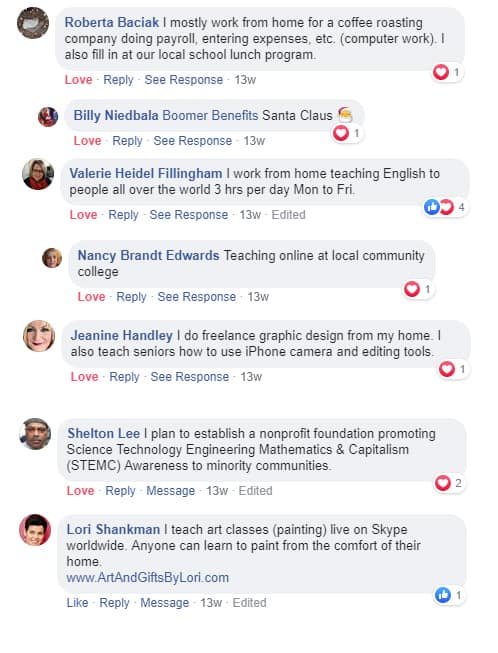

Valerie Heidel shared with us that she uses an online teaching platform called Cambly to teach English to students in Saudi Arabia, China, Japan, and even Brazil. She found this job opportunity by searching online for work from home part-time jobs. This work-from-home part was a must so that she could make her own schedule and work only when she feels like it.

What was also important to Valerie in finding a side hustle was the sense of purpose and productivity. And, because she has quite a few repeat weekly students, the job gives her spending cash. She earns $0.17 per minute that she is online with a student, which comes out to $10.20/hour.

Not bad for a job that doesn’t require her to leave her house. And this part-time gig doesn’t require a degree either. You can be approved for teaching gigs like this one in as little as two days (although for some applicants it can take up to two months).

Another retiree we spoke with shared how she used her part-time teaching income to transition into retirement. Our client Nancy was teaching full-time at one college while also teaching health courses part-time online as an adjunct instructor. When she was laid off from her full-time job unexpectedly, she was able to transition into semi-retirement by keeping the part-time health teaching.

J.D.’s note: When Kim’s father retired from teaching high-school English, he too picked up some extra cash by teaching college-level English classes online.

Nancy shared that she has a physical disability which would make it difficult for her to teach in a classroom or report to an office for work. The ability to teach right from her laptop through the school’s Learning Management System has even allowed her to work when she was hospitalized. Once the courses are created, her main duties are to respond to emails and grade assignments.

She loves that it keeps her active and says that she would be bored without this job, so she plans to continue teaching for as long as she possibly can.

Nancy shared that she and her spouse currently use her part-time income to supplement their Social Security income benefits so that they can avoid dipping into their retirement savings for as long as possible.

Takeaway: Nearly everyone has a skill that they could turn into a tutoring, teaching or mentorship position. In addition to Cambly, you can check for opportunities that fit your skills at sites like Tutor, Skooli, and Yup.

Turn Your Passion into Part-Time Income

Jeanine Handley has been a creative artist all her life and worked in graphic design. Now that she’s retired, she does remote graphic design work for clients out of her own home.

Jeanine Handley has been a creative artist all her life and worked in graphic design. Now that she’s retired, she does remote graphic design work for clients out of her own home.

She’s also managed to turn this passion into a business right in her own neighborhood. Several years ago, when she relocated to Florida, she moved into a 55+ community. Many of the residents there are active seniors who want to learn and explore new things in their own retirement.

Jeanine noticed that many residents didn’t know how to use the camera and editing features on their smartphones. She helped one woman in her eighties by picking out a new smartphone and iPad and began weekly lessons to show her how to use both.

This blossomed into a course there in the community in which Jeanine helps to introduce other folks to smartphones and smartphone photography. She can communicate and teach these skills in a manner that other seniors understand and appreciate.

Jeanine charges a small fee for this and the money she earns helps to supplement her income and be able to afford some of the extra things like travel, entertainment, and dining out.

As an artist at heart, she doesn’t plan to ever retire this side hustle. Think about your own hobbies and passions. Could there be a way for you to turn that into an income-producing side gig?

Another side-hustler who plans to never retire is our client Billy who is a professional Santa Claus.

That’s right. Santa Claus! How cool is that for an income booster?

As a member of three professional Santa Claus organizations, Billy appears everywhere from schools and restaurants to big city events to spread the holiday cheer. He stresses that this side-hustle is one that really comes from your heart and not from the boots and suit that you wear.

He enjoys talking to children of all ages and listening to their needs. Sometimes the job can require emotional fortitude as the requests aren’t always about gifts or toys but sometimes may include a plea that Santa helps a child’s father find a job.

Yet, even so, Billy admits that what he enjoys most is visiting homes of children who are either chronically ill or home-bound. These visits fulfill his heart while the side income he earns helps him and his wife to pay some of their expenses in retirement.

Being Santa can be a serious business both emotionally and professionally. Billy must pass a criminal background check each year and has regularly attended schools and seminars to perfect his craft. He’s also a member of three professional Santa Claus organizations.

Takeaway: Think about the things in your life that you absolutely love to do. Could your passion benefit someone else? How could you monetize that so that you can earn some income while performing activities that hardly feel like work at all?

Become a Contractor for Your Former Employer

When Roberta Baciak retired from working in a local school lunchroom, she felt so bad about leaving them that she volunteered to be a fill-in worker whenever they are short-staffed. They were quick to take her up on her offer, so now she works one day a week every week and sometimes gets called in on other days.

She also works from home 15 hours a week as an administrative assistant for a coffee shop and roasting company owned by her daughter and son-in-law. She takes care of their invoices, payroll, entering expenses into Quickbooks, sending statements and things like that.

Her side hustles have afforded her the ability to pay off some medical bills and to have some pocket cash to spend on little things her grandsons. She also loves the honor of helping her family with their growing business.

She plans on working as long as she can for her family and probably another year or so at the school lunchroom because she enjoys seeing her co-workers and the kids at school.

Roberta recommends that other retirees looking for side-income check with their local schools because lunchrooms are often looking for people who are willing to fill-in on an on-call basis.

Takeaway: Consider negotiating part-time employment with your last employer before retirement. You never know when they might agree! If that’s not an option, who do you know that has a business? Are there any part-time services that you could offer to them with your skills?

Get Financially Fit with Furballs

I honestly can’t think of a side gig I would enjoy more than getting paid to hang out with some fur kids. Busy working professionals are using pet sitting services more than ever – J.D. tells me he frequently uses Rover to book walks for his dog — and what’s great about this particular job is that you could work contract through a pet sitting service, or you could just post your services in neighborhood sites like Nextdoor.

This side hustle is really flexible because you can work only when you want to, and you can pet site in your own home or in someone else’s home for a little more cash.

I myself am a busy entrepreneur, working long hours at the office and frequently traveling for business. When I’m going to be gone overnight, I pay a friend’s mom, who is retired, to come and spend the night with my fur babies.

It helps me sleep at night to know that someone is caring for them, but I also know the love that my pet sitter is a retiree who can really use the money to help her make ends meet. It’s a win-win for everyone.

Not sure about overnights? You could start with someday visits or dog-walking, both of which are other pet services that many working people willingly pay for.

Takeaway: This one is possibly the easiest side gig of all to get started in. Post on your favorite neighborhood app or sign up as a pet sitter or dog walker with sites live Rover or Wag.

What Will Your Next Side Hustle Be?

These are just a few of the fun and creative ways to earn extra retirement income that some of our own social media followers at Boomer Benefits have shared with us. No matter what type of work you used to do, there are endless opportunities for new things that you can do once you are retired to supplement your income from Social Security and investments.

If teaching or pet sitting isn’t your thing, check out our post on 50 Ingenius Ways to Earn Money in Retirement for additional inspiration. You might also check out Ryan Helms’ Hustle to Freedom podcast, which is one that I’ve referred dozens of people to when they’ve shared that they want to work part-time but aren’t quite sure doing what.

The key is understanding that our digital world really does make it easier than ever to put a few extra dollars in your pocket each month and sometimes just that little bit makes all the difference.

Happy Hustling!

Author: Danielle K. Roberts

Danielle K. Roberts is a founding partner at Boomer Benefits, a national agency specializing in Medicare-related insurance products since 2005. Boomer Benefits helps baby boomers learn the ropes regarding Medicare. Danielle also writes frequently about Medicare, retirement, and personal finance topics and has been published or quoted in Forbes, Business Insider, CNBC, and other media outlets. She is a member of the Forbes Finance Council.

Recent Comments