Every Monday morning, Tom and I have a Zoom call to discuss the coming week’s priorities for this site. For the past couple of months, we’ve been focused on behind-the-scenes stuff as we prepared to launch the redesign. (That, and I was working on my course for Audible.) Now that the redesign is (mostly) finished, we’ve begun talking about content. What sorts of articles do we want to write in the coming weeks?

“You know,” Tom said this morning, “it wouldn’t kill you to write about the financial tools you use. You love your credit card, right? And you use Personal Capital? If you were to write about this stuff, we could make more money.”

As I’ve mentioned many times, Get Rich Slowly earns little compared to other sites its size — especially other financial sites its size. Expected earnings for GRS are probably on the order of $20,000 per month; we bring in about $5000. (And right now, because of the coronavirus, are revenue is lower than this even.)

Our low earnings are mostly because there are certain things I refuse to do here. I’m okay with ads, but I’m not okay with video ads. (Even the “sticky” bottom banner ad bugs me. I hope one day to ax it.) I refuse to publish “paid posts”. I don’t like “listicles” that act as thinly-veiled money grabs. And I’ve been reluctant to run many reviews (aside from book reviews).

But for the past eighteen months, Tom has been patiently making the case that reviews of products and services don’t have to cross that thin green line. Done properly, they can be a win-win. They can provide readers with good info while also generating a little income. The key is to keep the reviews honest, not praise, and promote something simply because we get paid for sign-ups.

“People want reviews,” Tom says. “They find them helpful.”

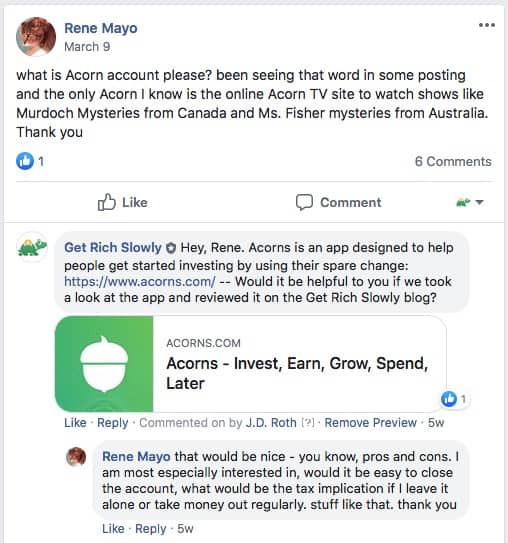

As if to bolster Tom’s argument, we’ve been fielding a lot of questions lately about various products and services. Here, for instance, is a recent post from the Get Rich Slowly community on Facebook. One woman wants to know more about Acorns, an app designed to help you “invest your spare change”.

Based on this — and other reader interactions — it’s clear that people do want to know about apps and tools and services. Avoiding these reviews doesn’t necessarily serve my audience the way I think it does.

One problem is that, so far, I haven’t actually used most modern apps. I’ve dabbled with YNAB. I do use Personal Capital, but only for a couple of specific things. But most of my money management is still done with Quicken 2007. I don’t use an app to invest. When I buy and sell stocks — which isn’t often — I do so directly through the Fidelity website. And while I do indeed love my credit card (and probably ought to publish a review of it), I can’t see myself applying for and reviewing a whole bunch of other cards.

Anyhow, I’ve accepted the premise that Get Rich Slowly should review more financial products and services. Done right, these reviews don’t have to be shady. I see now that they can be useful. While my own financial life might not be very modern, that doesn’t mean that yours has to be outdated too.

Here’s where I’m turning to you, my friends. I need your help.

- What financial products and services do you currently use? Of these, which do you most recommend? And which do you use out of habit — or because you haven’t been able to find anything better?

- What financial products and services are you curious about? What tools have you been wanting to learn about?

- If you read other money sites, which ones do you trust for reviews — and why? Can you point to some examples of people who do reviews right?

Instead of being stuck in the past, it’s time for this old dog to learn some new tricks. When I started GRS, financial apps weren’t even a thing. The web was young(-ish). Smartphones were in their infancy. People didn’t manage their money online. Today is different.

Now, there’s a plethora of apps and sites and tools out there, and sometimes it’s tough to know which are useful — and which are not. While there’s no danger that Get Rich Slowly will ever turn into a review site, I concede that doing some reviews could help people sort the wheat from the chaff. And as we prepare to ramp up the publishing schedule around here — yay! — it’d be helpful to have a list of financial tools that readers want us to write about.

So, help us decide which products and services merit a closer look!

Recent Comments